In an only-in-San Francisco moment, lawmakers push union-like protections in buildings with five or more tenants, whether rent-controlled or not.

Every Labor Day, Bornstein Law has paid homage to a pantheon of figures who have fought to raise wages, shorten hours, and provide supplemental benefits. In the words of John F. Kennedy, it was “through collective bargaining and grievance procedures labor unions have brought justice and democracy to the shop floor.”

Now, will these same protections be extended to apartment buildings?

For San Francisco Supervisor Aaron Peskin, there should be solidarity between tenants in all buildings with five or more units. Borrowing from the “storied playbook of labor,” the Supervisor has crafted a proposal that would amend the Administrative Code to compel a dialogue between landlords and tenants.

This discourse is not optional; landlords would have to recognize “duly-established tenant organizations” and come to the table to discuss “landlord-tenant regulations, and/or similar issues of common interest or concern among tenants in the building.”

If landlords refuse to meet and engage in a constructive meeting of the minds, tear down flyers, harass organizers or otherwise don’t give a megaphone to tenants that want to organize, it is considered a reduction in services, and the tenants, in turn, can petition the Rent Board for a corresponding rent reduction.

Excessive protections for a city that already has a plethora of safeguards for tenants?

For Charley Goss of the San Francisco Apartment Association, the potential legislation is overkill and would fuel “hostile interactions and an ‘Us versus Them’ environment which will unnecessarily deteriorate and politicize the landlord-tenant relationship,” he told TheRealDeal.

We agree. San Francisco has the most ensconced protections anywhere. Wrongs can be righted through the court and the Rent Board. Inspectors can be called upon to identify inhabitable living conditions. And let’s not forget there is no shortage of tenants’ attorneys willing to air out grievances, often at no charge thanks to the “no eviction without representation” movement.” According to Supervisor Dean Preston, the city’s program to provide free legal aid to tenants is fully funded for the first time in years.

A law that requires compulsory meetings would only create an adversarial tone between landlords and tenants, even if both parties are communicative and no conflict exists.

Although it is a good practice to have a fluid dialogue with tenants and hear their concerns, “forced meetings don’t typically result in success,” Daniel Bornstein commented when we first heard of the proposal to give tenants union-like protections.

Tenant unions are not a new concept in San Francisco

There are already lively activities being orchestrated by tenant unions. The Veritas Tenants Association, for instance, is staging a debt strike because they feel marginalized. The city’s largest landlord asserts that it is engaging in productive conversations with tenants and there is no reason to disbelieve them.

Indeed, we noted early on in the pandemic that Veritas was a good corporate citizen and a pioneer in forgiving rent debt even though they weren’t required to do so. This act of generosity didn’t go far enough for tenants’ activists.

While nothing currently prohibits tenants from banding together, landlords are not required to formally recognize and meet with a tenant organization. The proposed legislation would change that – landlords would have to come to the table.

Some key provisions to digest

Although landlords can set reasonable guidelines for the time, place, and manner of tenant organizing activities – these campaigns cannot get too rowdy and interfere with the quiet enjoyment of residents – this outreach must be allowed in common areas of the building.

The organizers are allowed to go door-to-door to distribute literature and educate fellow tenants on joining a tenant organization.

Noteworthy, however, is that the tenant who does not want to join the movement can say “no thanks” and the activists must honor their requests. Any literature placed on or in front of the tenant must give the name, telephone number, and address of the distributor. The organizer would have the right to convey information, but tenants have the right to bow out of any future entreaties. No means no.

What is a “tenant organization” anyway? It is not just a group of five or more tenants who are mad as hell. It requires some structure.

In order to be recognized as a bona fide tenant organization, organizers must provide a petition signed by at least 50% of the occupied units in the building expressing that they want to form a tenant association.

We find this to be a low bar – residents are only asked if they would like to have a say in airing out concerns with the landlord, so the necessary written statements should be rather easy for the organizers to obtain, whether those statements are by individuals or collective written assertions to participate.

Once formed, tenant associations are required to hold regular meetings open to all residents of the building and elect officers to serve for two-year terms.

The proposed ordinance requires that both landlords and tenant associations “confer with each other in good faith.”

While this is an ambiguous term that may ultimately be litigated in front of the Rent Board, suffice it to say that both parties should hear each other out and invite a free-flowing exchange of information.

Certainly, landlords should take copious notes of correspondence with the tenant organization and document any concerns raised, along with any course of action taken to come up with an amicable resolution. When landlords formally meet with the tenant’s association – as would be prescribed by law, or perhaps on a more frequent or impromptu basis, meeting minutes should be recorded.

The tenant association could claim in front of the Rent Board that the landlord did not engage in good faith discussions, but what we want to do is provide a counter-narrative.

Tenants’ advocates are a resilient bunch. Their motto seems to be if a measure fails, try, try again.

A similar bill died on the vine in the statehouse. SB 529 would have given tenant associations the right to get together and withhold rent. Supervisor Peskin’s proposal stops short of allowing tenants to stop paying rent; the Rent Board would be the final arbiter of whether or not a rent reduction is warranted. Bornstein Law has not been a Johnny-Come-Lately on this subject.

Read our earlier blog: Withholding rent in the spirit of protest

Parting thoughts

In the eventuality San Francisco’s law passes, what can a landlord do? It has been said, “if you can’t beat them, join them.” Conceivably, we can question the validity of a self-professed tenant organization and say that they did not comply with the procedural requirements to call themselves a tenant organization. This would only deteriorate the rental relationship.

Better, in our view, to continue and amplify communication with tenants. Interestingly, the proposed legislation would not require landlords to act on every request made by a tenant organization or rush to fix a perceived problem that is voiced. The law merely requires concerns to be heard.

Of course, Bornstein Law stands ready to facilitate this communication and represent landlords in front of the Rent Board if the tenant organization decides to escalate the matter and argue for a reduction in rent.

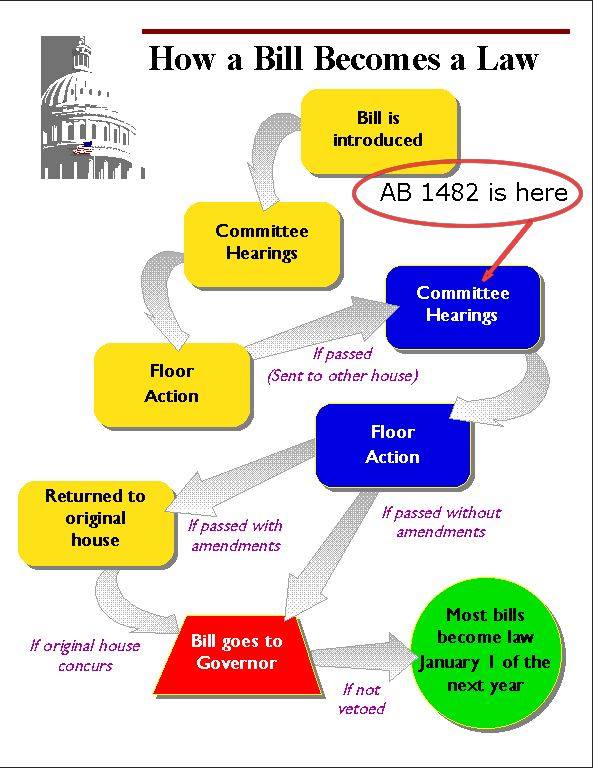

Please stay dialed into future developments and edicts. The proposal has not been signed into law yet, but given the San Francisco Board of Supervisors’ affinity for tenant protections, we have no reason to believe that the measure will not sail through.

Zoom meetings and other virtual conferencing have become the new normal and nothing in the raw language of the proposed ordinance prohibits landlords from meeting with the tenant organization members remotely – we feel this would be the best venue to bring all parties on the same page to fulfill the spirit of the law of giving tenants an easy platform to speak their minds.