We have said in many venues that rental property owners in Oakland are swimming upstream against an ever-expanding regulatory regime. Now, “vacant” property owners – loosely defined as owners of properties that go “unused” for more than 50 days – will be hit directly in their checkbook, thanks to the passage of Measure W, also known as the Oakland Vacant Property Tax.

Voters resoundingly said yes for the measure, aimed to fund homeless programs and services, affordable housing, code enforcement, cleaning up blighted properties and illegal dumping. The law was cleverly marketed – who can be against ending endemic homelessness and removing eyesores from the neighborhood?

Bornstein Law applauds efforts to tackle these problems, but we think that property owners have been saddled with an inordinate amount of blame. There are a multiplicity of factors that have contributed to Oakland’s growing pains, but it seems that the owners of underutilized properties are an easy but misplaced target for a punitive tax.

In the news: Other people agree with our sentiment that the law lacks clarity. Get a backdrop here.

In our viewpoint, a better course of action would be to remove maddening regulations that stand in the way of owners who want to build on their so-called vacant land.

Our opinion notwithstanding, our job is not to legislate, but to educate property owners on the laws on the books. There’s much we know about Measure W, and much that is up in the air as its implementation takes shape, so let’s start with what we know.

What the law says

Starting July 1, 2020, properties deemed vacant will be taxed $6,000 annually if it is a residential, non-residential and otherwise undeveloped property. A $3,000 annual tax will be imposed on vacant condominiums, townhouses and duplex units. Ditto for ground floor commercial space parcels, which will also be taxed $3,000.

These funds will go into the coffers of the County of Alameda. The first billing will be in included in the Fiscal Year 2020-2021 Secured Property Tax Bill, which covers the period of July 1, 2020, through June 30, 2021, for property deemed vacant in 2019. The payment due dates and the collection of delinquent Vacant Property Tax are at the same time and in the same manner and subject to the same penalties and procedures as the Secured Property Tax Bill by the County of Alameda.

Exemptions are made for very low-income households, low-income seniors and individuals with disabilities. Owners who can demonstrate that the tax would lead to financial or other hardship are also exempted. We might submit that the tax would constitute a hardship for anyone affected, and so it’s unclear how the city will define this ambiguous term. It seems that Oakland will recognize effort – owners of properties being developed will be spared of the tax, as will non-profit owners.

A commission on homelessness will guard the cookie jar by overseeing how the funds are allocated, with the City Auditor checking in every now and then, and so while we noted earlier that owners of vacant properties should not shoulder the expense of solving intractable problems, there appear to be layers of transparency to ensure the funds are being put to good use.

Much remains uncertain

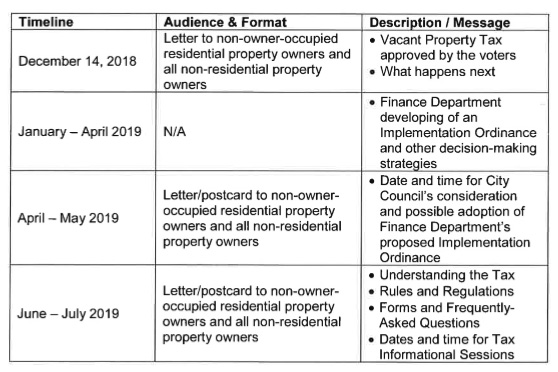

Like most other matters that cross our desks, the law is cleaner on the page than it is in real life, and the City’s Finance Department seems to agree. That body is tasked with the tall order of formulating a plan for City Council to implement and administer the ordinance, and so there are many unknowns. To their credit, the Finance Department has welcomed public comment and has come up with the following timeline in the deliberative process.

In an introductory letter sent to property owners as part of a public awareness campaign, the city concedes there will be many wrinkles to be ironed out and that there is not enough staff to respond to inquiries.

Bornstein Law, however, has the time and resources to engage. Contact our office for informed advice on how this and other laws impact your bottom line as a property owner.